Key insights

- The Department of Justice sanctioned Bitzlato in 2023 for transmitting illicit funds, including over $700 million in cryptocurrency from Hydra Market

- The Global Ledger team analyzed cryptocurrency traffic on the Hydra darknet marketplace to discover other companies with similar exposure to Hydra

- At least five, including Binance, Huobi, and WhiteBIT, enabled fund transfers with wallets associated with Hydra. Two more continued operating even after being sanctioned

- Five exchanges persisted in handling transactions even after the marketplace’s closure

In recent years, there has been a sharp turn in attention from regulators and law enforcement toward those using cryptocurrencies for shady dealings. Think money laundering from ransomware attacks, scams, or darknet deals. 2022 saw the likes of Blender.io, Tornado Cash, Hydra, and Garantex facing the heat for such acts. Now, in 2023, Bitzlato.io joins the list.

The investigation process might be long and winding, but the message from watchdogs is clear: they are taking no prisoners when it comes to money laundering using crypto. With this backdrop, the Global Ledger team set out to uncover a burning question: Who is next on the regulatory radar?

Our research approach

The research tracked fund flows linked directly with the Hydra darknet marketplace. After all, these very connections landed previous organizations in hot water.

Our investigation took a deep dive into data from 2021 to 2023, circling around April 5, 2022. That is the day the Department of Justice announced the Hydra Market seizure.

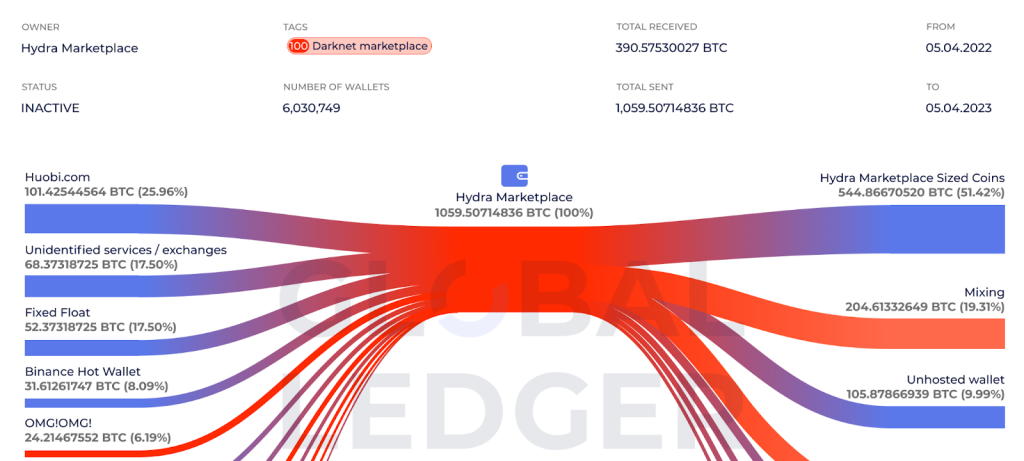

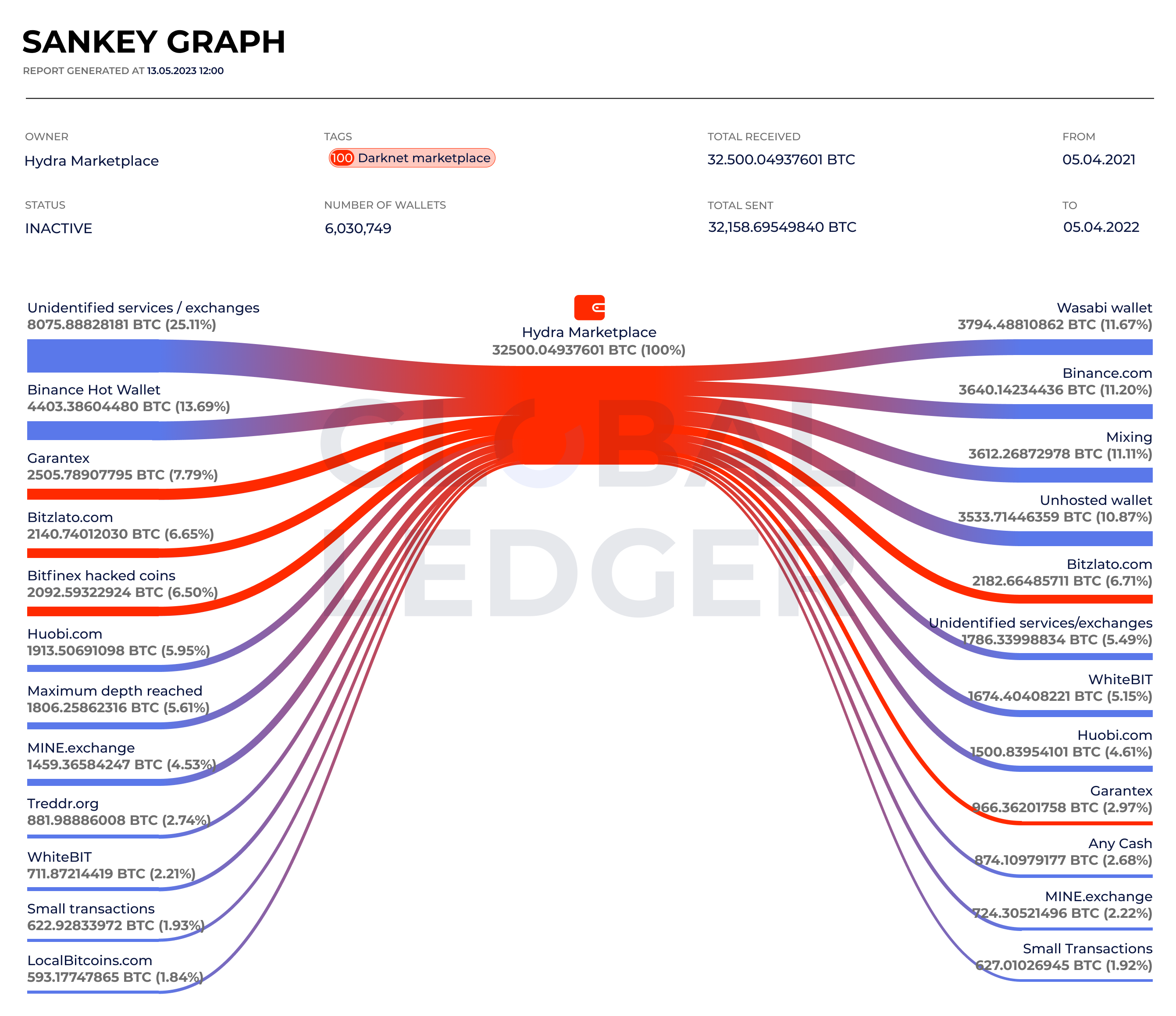

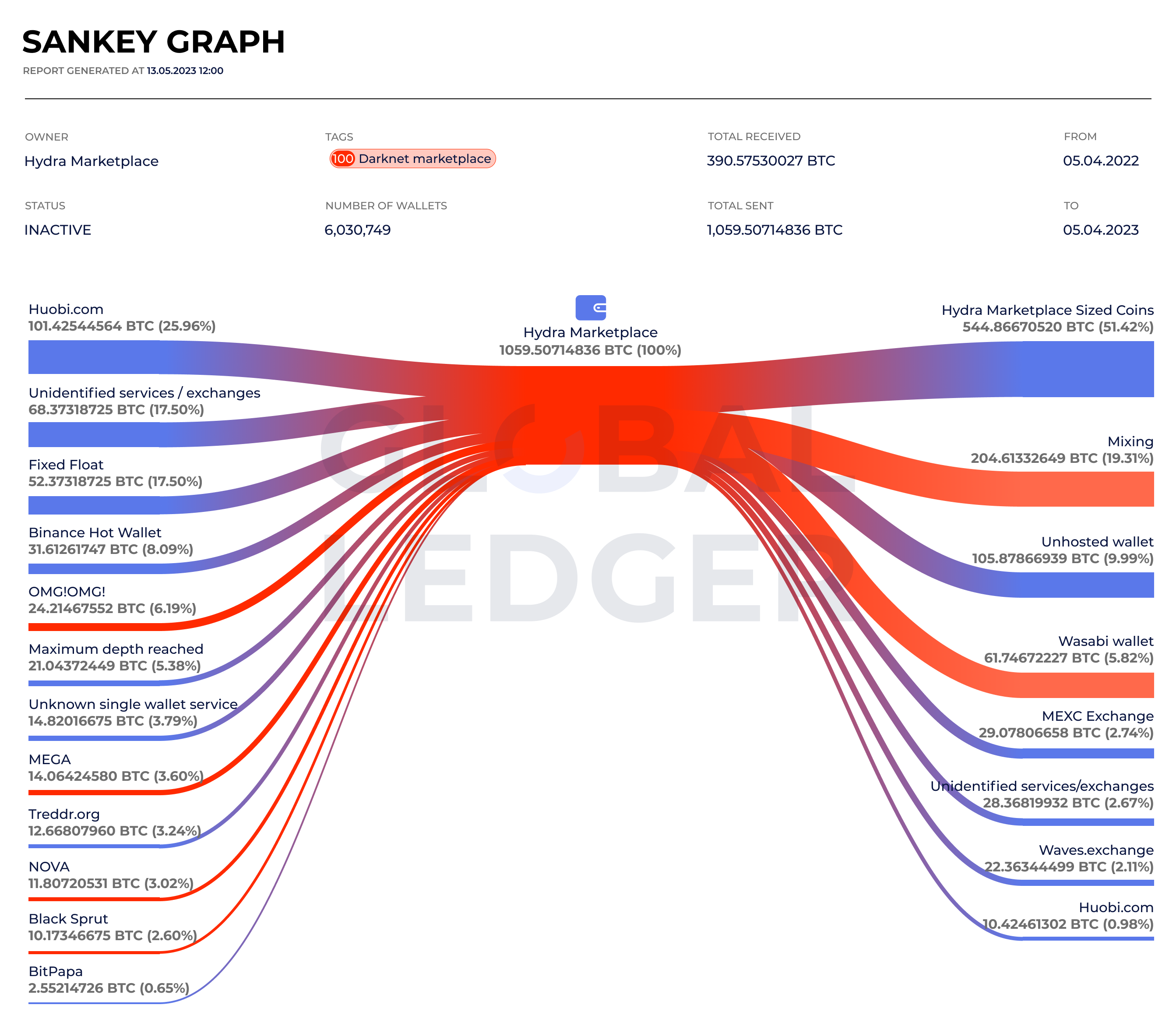

The team has analyzed data from 6,030,749 wallet addresses and aggregated it into a chart. The latter displays the Hydra darknet marketplace’s prominent sending and receiving counterparties. We see the flow of funds users deposited to Hydra on the left. The data on the right shows the withdrawals made by users and vendors.

Received and withdrawn BTC via Hydra Marketplace wallets from April 5, 2021 to April 5, 2022

Received and withdrawn BTC via Hydra Marketplace wallets from April 5, 2022 to April 5, 2023

Core insights from the data

- Halted activities

Sealing off the marketplace had quite the effect. Hydra’s activity came to a screeching halt, with over 98% drop in received amounts and a whopping 96% in sent funds.

- Traffic

A year before Hydra was shut down, its predominant traffic was from legitimate exchanges. But after April 5, 2022, things took a dark twist. Hydra’s traffic started flowing mostly from other darknet marketplaces like BlackSprut, OMG!OMG!, Nova, and Mega. The number of exchanges involved in these operations reduced significantly.

- Forecast

The numbers suggest which exchanges might be treading on thin ice. Bitzlato funneled 2140.7401 BTC into Hydra and drew out 2182.6648 BTC. Taking this amount of funds sent/received from Hydra as our red flag, we have zeroed in on the top 5 exchanges that might be under the spotlight.

The top 5 potential targets for sanctions

1. Binance

Binance has repeatedly faced scrutiny over funds associated with Hydra, though consistently refuting any direct links. They often cite “indirect transactions” or substantial support in probing significant laundering incidents as their defense.

Data reveals that in the year leading up to Hydra’s cessation, Binance was involved in transferring 4403.3860 BTC to Hydra and received around 3640.1423 BTC from them. Notably, even post-sanctions, Binance maintained transaction capabilities with darknet marketplace wallets.

2. Huobi

In December 2021, a study from the British National Bureau of Economic Research spotlighted Huobi and Binance as potential conduits for money laundering in relation to Hydra. 1913.5069 BTC went from Huobi to Hydra, and around 1500.8395 BTC were transferred back. Interestingly, Huobi, like Binance, persisted in transactions with Hydra-associated wallets even after sanctions were imposed.

3. MINE.exchange

According to our research, MINE.exchange recorded a significant flow of bitcoin to and from Hydra wallets within a year – 1459.3658 BTC sent and 724.3052 BTC received.

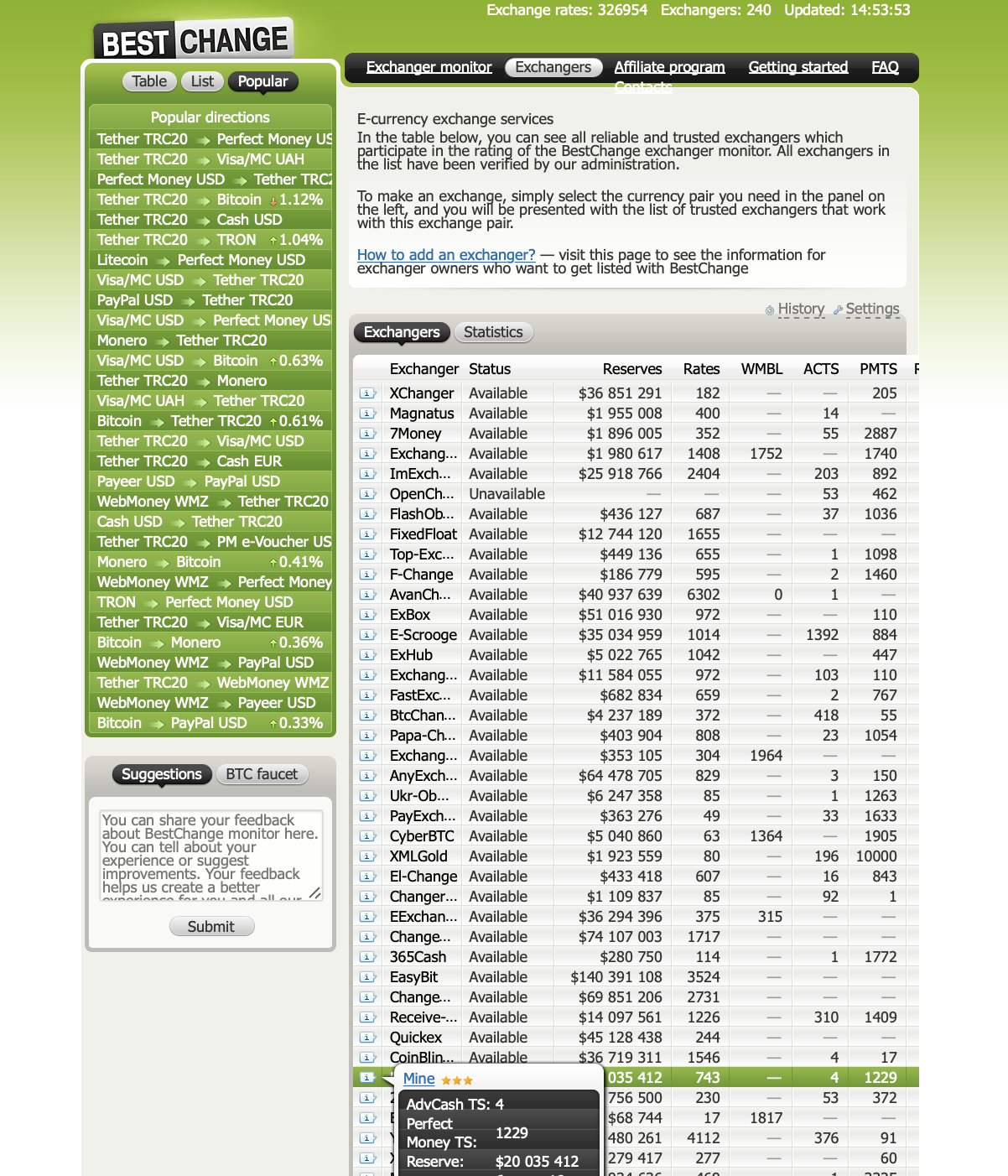

Moreover, its website, available in Russian and English, sees over half its traffic from Russia, as per similarweb.com. Notably, it is a top player on Bestchange.com, a platform showcasing OTC rates in various Russian regions, boasting around $20 million in reserves.

Image source: Bestchange.com

4. Treddr.org

Its story parallels that of MINE.exchange. 881.9886 BTC were transferred from Treddr.org to Hydra. Their primary service is exchanging BTC for rubles via banks like Sberbank, Tinkoff, Alfa Bank, VTB, and others, many of which faced international sanctions. Despite this, Treddr.org kept enabling fund transfers with Hydra-affiliated wallets.

5. WhiteBIT

The data regarding this Ukrainian platform paints a vivid picture: WhiteBIT oversaw the transfer of about 711.8721 BTC to Hydra and 1674.4040 BTC from them.

Bitzlato and Garantex*

In the period studied, Garantex dispatched approximately 2505.7890 BTC to Hydra, receiving 966.3620 BTC. For Bitzlato, the figures stood at 2140.7401 BTC sent and 2182.6648 BTC received.

*Both exchanges have previously faced sanctions because of dealing with the darknet marketplace. Despite Garantex losing its Estonian license due to AML/CFT inadequacies, it continues to operate. Bitzlato’s co-founder, Anton Shkurenko, mentions its relaunch in Russia, seemingly out of regulatory reach. This makes both exchanges still noteworthy in discussions about potential sanctions.

Post-Bitzlato crackdown

Lastly, some exchanges didn’t immediately sever ties after the Hydra shutdown. Their continued engagement with Hydra wallets, especially between 05.04.2022 to 05.04.2023, is noteworthy:

- Huobi – 101,4254 BTC

- FixedFloat – 52,7390 BTC

- Binance – 31,6126 BTC

- Treddr.org – 12,6680 BTC

- Bitpapa – 2,5521 BTC.

While the transaction volumes after the marketplace closure aren’t as staggering as before, the very act of transactions to Hydra-affiliated wallets can draw regulatory and law enforcement eyes to these exchanges.

To sum up

Our insights reveal several exchanges that may soon find themselves under the regulatory microscope due to their ties with the Hydra darknet marketplace. These exchanges fall into two distinct camps: those transacting with Hydra before its shutdown and those that carried on even after.

However, it is crucial to note that having Hydra-linked transactions doesn’t necessarily mean these exchanges neglected to flag or report suspicious activities to the authorities. Given the intensified global crackdown on crypto-linked money laundering and the synergy between regulators and law enforcement agencies, it is plausible these exchanges could be under tighter surveillance. Such oversight could further diminish dealings with rogue actors, nudging the industry towards a cleaner future.